The reliable and well-developed business environment in Macedonia lets foreign investors establish their presence on the market in a large number. Having a proper registration structure and a permissive legislation, Macedonia welcomes foreigners to set up a wide range of companies like limited liability companies, subsidiaries or branches. Since 2011, the authorities established the one-stop shop system or the Central Registry of Macedonia through which all companies, local and foreign, are registered. If you want to set up a branch in North Macedonia, our company formation agents in Macedonia are at your disposal with complete support and information in this matter.

| Quick Facts | |

|---|---|

| Applicable legislation |

For foreign countries |

|

Best used for |

– banking, – insurance, – financial activities |

|

Minimum share capital |

No |

| Time frame for the incorporation (approx.) |

Around 3 months |

| Management |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Dependent on the parent company |

| Liability of the parent company | Full liability on the branch office's debt and obligations |

| Corporate tax rate | 10% |

| Possibility of hiring local staff | Yes |

| Definition of a branch in Macedonia |

A type of firm established by a foreign company to extend its services, operations, or presence in Macedonia. |

|

General documents required for opening a branch |

– parent company’s Articles of Association (notarized), – extract from the foreign commercial registry, – agreement between the parent company and branch, – information about branch’s activities, – minutes of the meeting of branch establishment, etc. |

|

Possibility of setting up multiple branches (YES/NO) |

YES |

| Steps of opening a branch |

– prepare the documents, – appoint representative, – register with Trade Register, – register with tax authorities, etc. |

| Tax returns |

By the end of February or by 15 March of the following year, if taxes are filed electronically |

| Remote registration |

We handle company incorporation in Macedonia and branch registration remotely through power of attorney. |

| VAT rate |

18% (standard); 5%, 0% (reduced) |

| Branch name |

Usually the same name as the parent company. |

| Authorities overseeing branches in Macedonia |

Central Register of Macedonia |

| Alternatives to a branch office | Our specialists in company formation in Macedonia can help you open alternative entities, such as a representative office or a subsidiary. |

| Minimum directors/shareholders required | None |

| Number of double taxation treaties in Macedonia |

33 (approx.) |

| Other taxes in Macedonia |

– custom duties, – excise duties, – social security contributions, – withholding taxes, etc. |

| Advantages of opening a Macedonian branch |

– market expansion, – low tax rates, – brand recognition, – easy incorporation process, – strategic location in Southeast Europe, etc. |

| Assistance |

We can help you open a company in Macedonia or expand your business by establishing a branch. |

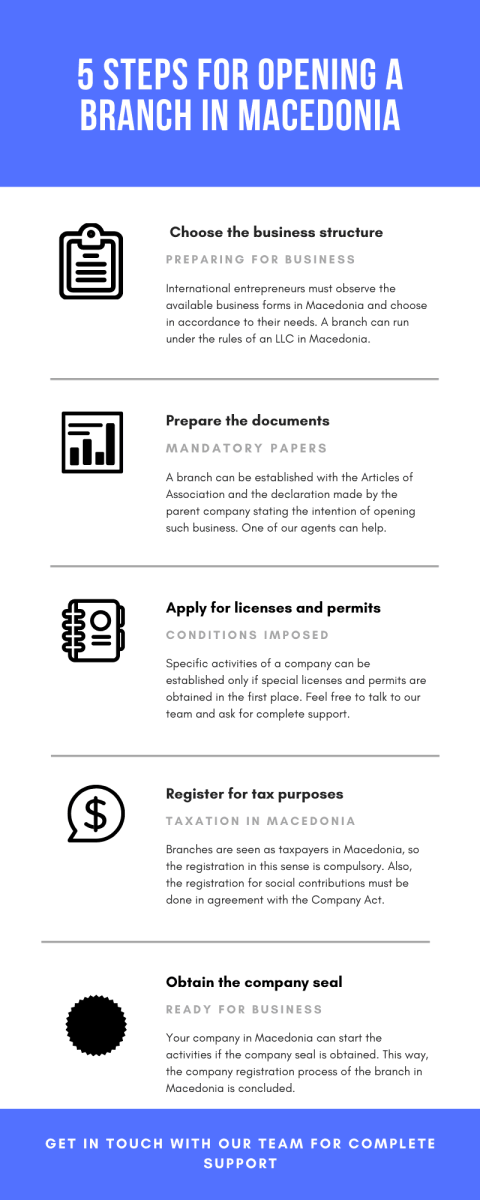

Necessary documents for setting up a branch in North Macedonia in 2023

The registration process of a company in Macedonia is simple and allows foreigners to operate on the market in a fast and reliable manner. Branches enter the same category, but complete attention needs to be offered when preparing the documents like:

- the certificate of incorporation of the foreign company (this needs to be notarized);

- an agreement through which the parent company agrees on the branch opening in Macedonia;

- an extract from the foreign commercial registry which shows the registration date of the parent company;

- information about the parent company (capital share, the name of the owners):

- a document providing details about the future operations of the branch;

- the minute meeting of the branch establishment details in Macedonia.

It is good to mention that all companies in Macedonia must have a representative person who is normally appointed by the owners of the company. Another enterprise may represent the activities of your branch if it is necessary. Also, a board of managers is mandatory when operating as a branch in Macedonia. Please bear in mind that for any company formation in Macedonia in 2023, regardless of the chosen entity, we suggest you address your requests to our company incorporation specialists in Macedonia.

10% rate is the corporate tax for branches established in Macedonia, which is a great advantage for international investors looking for business in this region. The VAT is another important tax that should be considered at the time of incorporation.

Can I establish more than just one branch in Macedonia?

It is good to know that foreign investors can establish more than just one branch in Macedonia, the registration procedure remaining the same with the authorities in charge. In this matter, the central branch must be established at the time of the incorporation. Furthermore, branches in North Macedonia can perform activities only if the parent company agrees in this sense. For a better understanding of how branches work in Macedonia, you can talk to our consultants.

There is no need for a minimum share capital for a branch in Macedonia, compared to subsidiaries for which a paid-up capital of EUR 5,000 is needed in a local bank account.

The obligations of a branch in Macedonia

Branches in Macedonia operate on the market in compliance with the Companies Act and the Commercial Code. The same rules and regulations imposed on local investors totally apply to foreign investors, regardless of the chosen business entity in Macedonia.

Do I need to register the annual financial statements for my branch?

Branches are obliged to register the financial statements and all the reports in agreement with the legislation of the country and the internal rules of the parent company. The Macedonian Central Registry must receive information about any changes made in the established branch. Likewise, any branch established in Macedonia must have an accounting department or can externalize the services. Branches in Macedonia have complete support from the parent companies compared to subsidiaries which run independently. More about requirements for branches in 2023 can be discussed with our specialists in company formation in Macedonia.

Taxes for branches in Macedonia

Investors who decide for a branch in Macedonia should know that the tax regime is extremely favorable and one of the lowest in Europe, with an appealing corporate income tax rate. The corporate income tax or CIT as it is known is set at 10% in Macedonia. Companies establishing branches in the free trade zones in Macedonia can benefit from tax reliefs for 10 years. It is good to know that the withholding tax for royalties, dividends, and interests is set at 10%. Moreover, one must observe the fact that there are no payroll, capital duty or branch remittance taxes in Macedonia.

Also, a branch in Macedonia is protected by a series of double taxation treaties signed by Macedonia with countries worldwide. This means that such entity will not pay the taxes twice, and more than that, branches can benefit from reduced taxes under certain circumstances.

Accounting and audit standards in Macedonia

The Company Law in Macedonia regulates the auditing matters for branches established in this country. Also, the International Standards of Auditing published in the Official Gazette also apply to such types of companies in Macedonia. The same thing is available for the financial reporting of branches in Macedonia. It is important to have the support of an accounting firm in Macedonia that can take care of the financial matters in the firm, in agreement with the applicable laws in this country, including the international legislation. You may address your inquiries in this matter to our team of consultants in Macedonia and ask for advice and recommendations as soon as you decide for a branch in this country.

How fast can I register a branch in North Macedonia in 2023?

The registration of branches in Macedonia will pretty much depend on the documents provided to the Central Registry of the Republic of Macedonia. Normally, it takes a few hours until the company is registered in Macedonia through the local offices in the main cities. A great support can be provided by our team of company formation specialists in Macedonia who can speed-up the process of incorporation by helping with the paperwork among other aspects. Also, if you are looking for a representative for your branch in Macedonia, you can get in touch with our team and ask for advice and recommendations in this sense.

The act of establishing the branch in Macedonia issued by the parent company should not be older than 3 months, according to Macedonian legislation. Our local consultants can provide support with paperwork for company formation.

The trade agreements of Macedonia

Macedonia is part of a series of agreements meant to sustain the foreign investments and to align with the international business conditions. The Stabilization and Association Agreement or SAA was signed by Macedonia with the countries part of the European Union. EFTA or the European Free Trade Association was signed with Norway, Liechtenstein, Norway and Switzerland. CEFTA or the Central European Free Trade Agreement involves countries like Moldova, Albania, Serbia, Bosnia and Herzegovina, Kosovo and Montenegro.

Duty free access is given to more than 650 million consumers worldwide, thanks to the agreements signed by Macedonia. Such arrangements are applicable to branches and subsidiaries in Macedonia, alongside the double taxation treaties that protect companies from paying the taxes twice on incomes. Additional information about the important agreements signed by Macedonia and the ones that mention the branches in this country can be offered by our consultants who cal also help you with the VAT registration in Macedonia.

The liability of branches in legal transactions

It is good to observe the fact that the parent company is entirely liable for the operations and the results of a branch in Macedonia. The same goes for the legal transactions in the branch, regardless of the activities involved. We remind that our team of consultants can act on behalf of your branch in Macedonia and can represent you in the court of law in the case of a lawsuit, with a power of attorney.

Establishing the main branch in Macedonia

A company from abroad can decide on many branches in Macedonia. However, such a company must designate the main branch in the country. This is also known as the central branch office which will be mentioned by the documents submitted to the Trade Register in Macedonia, under a specific reference number.

Fields of interest in Macedonia

Most of the branches in Macedonia are seen in the banking sector which is highly representative in this country. However, the IT field, the automotive and the engineering are also important sectors in which foreign companies can decide on set up branches in Macedonia.

The benefits of opening a branch in Macedonia

There are numerous branches that successfully activate in the banking system in Macedonia. Also, branches are suitable business entities for activities in the tourism sector, IT, financial services, food industry and many more. Among the advantages of a branch in Macedonia, we mention the possibility of investing the profits in the company or transfer them to other branches of the same foreign company. It is good to know that branches in Macedonia can compensate the registered losses with the revenues of other branches established in other countries. We remind that branches in Macedonia can be easily established as there are fewer formalities and requirements. As for the responsibilities of branches in Macedonia, these directly concern the parent company.

Why open a company in Macedonia?

The macroeconomic stability plays a key role when determining the business direction as a foreign investor in Macedonia. Branches and subsidiaries are mostly met in the banking sector, with more than 25,000 units according to recent statistics. In terms of country advantages, Macedonia shows a low inflation rate for the past ten years and a stable GDP growth. The monetary and fiscal policies is in the attention of Macedonian authorities who want to create a proper business climate with a fiscal discipline and no major changes. A stable outlook is given by Standard & Poor’s, the most important rating agency in the world.

The financial system is also extremely important when deciding for opening a branch in Macedonia. Most branches and subsidiaries are found in the banking sector governed by two important sets of laws: the National Bank Law and the Banking Law, the latter presenting the liberalization of foreign banks and their activities in the market. Still referring to branches of foreign banks in Macedonia, the main condition is to hold monetary assets summing up EUR 2 million.

It is good to know that branches of foreign banks in Macedonia must have a license to perform the activities in the financial sector and that is normally issued by the National Bank of the Republic of Macedonia. Even insurance companies from abroad can establish branches in Macedonia, in agreement with the provisions of the Insurance Supervision Law, the Compulsory Insurance in Traffic Law and the decisions in this sense made by the Constitutional Court of the Republic of Macedonia.

Insurance agencies and brokerage companies can be easily established in Macedonia under the rules of branches and performing several activities like insurance intermediation, life and non-life insurance, insurance supervision and many more. The excellent infrastructure and the growing FDI make investors from countries like Germany, Italy, Switzerland, Greece, USA, Russia, the Netherlands, China, the UAE, the UK, Turkey, Ukraine, Austria, or Spain to establish branches in the Republic of Macedonia.

Foreigners interested in establishing a branch in Macedonia in 2023 are invited to ask for comprehensive support at the time of registration our Macedonian team of agents in company formation. Please contact us at any time.