The bountiful and appreciated business climate of Macedonia allows foreign investors to form varied companies in respect to the applicable legislation. Among the legal entities which can be established in Macedonia, a subsidiary may represent a suitable option, due to an easy registration and financial support offered by the parent company. In terms of registration and formalities, our company formation agents in Macedonia can help investors establish subsidiaries in Macedonia at any time.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Company Law in Macedonia |

|

Best used for |

– banking, – insurance, – automotive, -IT&C, -manufacturing |

|

Minimum share capital |

Yes |

| Time frame for the incorporation (approx.) |

Around 4 weeks |

| Management (local/foreign) |

Local |

| Legal representative required |

No |

| Local bank account |

Yes |

| Independence from the parent company | Yes |

| Liability of the parent company | No, the subsidiary is fully liable |

| Corporate tax rate | 10% |

| Possibility of hiring local staff | Yes |

How can I register a subsidiary in Macedonia in 2023?

A Macedonian subsidiary is a legal entity which can have a wide range of activities including the ones of the parent company. We mention that a subsidiary in Macedonia can be established through a limited liability company by at least one shareholder and a minimum share capital of EUR 5,000. This type of business addresses to entrepreneurs interested in small and medium enterprises in Macedonia. The Articles of Association stand at the base of company formation in Macedonia including for subsidiaries and must be created in compliance with the Companies Act and the Macedonian Commercial Act.

It is good to know that subsidiaries in Macedonia can be private or public and are managed by a board of directors which is appointed by the shareholders of the subsidiary. For a better understanding of the rules and regulations related to subsidiaries in Macedonia in 2023, we suggest you address to our specialists in company incorporation in Macedonia.

According to Macedonian laws, hiring staff for subsidiaries in this country is made with local employment contracts. A period of probation is offered, and there is no restriction referring to personnel from foreign countries.

Do I need a representative for a subsidiary in Macedonia?

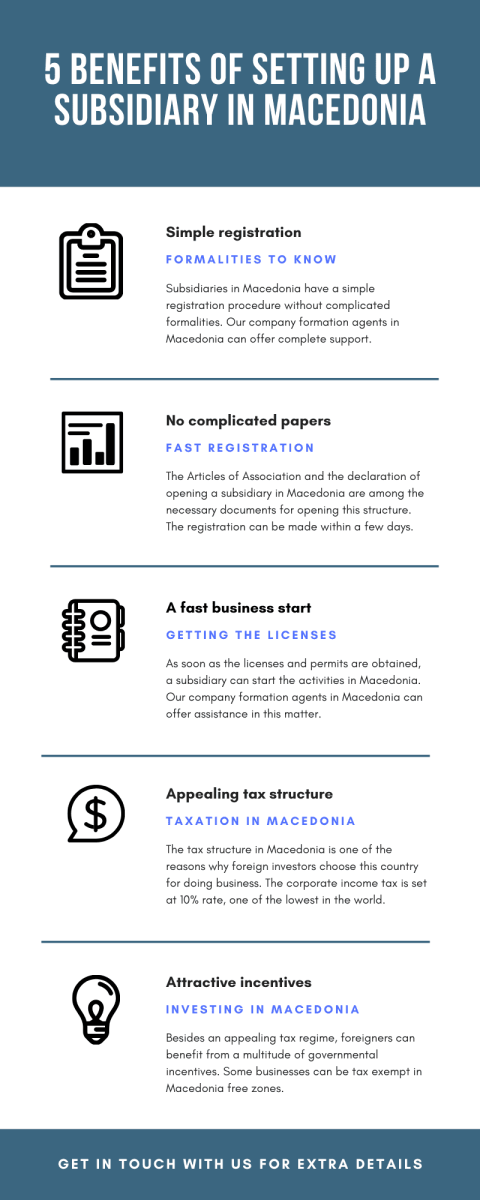

Yes, foreign companies and their subsidiaries in Macedonia need to be represented by a registered agent. This can be a natural person with residency in Macedonia or another company with establishments in this country. We remind that our team of advisors can represent your firm in Macedonia, whether it is a subsidiary, a branch or any other business structure. Here is an infographic with extra details:

The paid-up capital of EUR 5,000 is needed for a subsidiary in Macedonia, formed as an LLC. This is the minimum share capital for establishing such a structure. Our local agents can help you open a corporate bank account for a subsidiary in Macedonia.

The registration certificate of a subsidiary in Macedonia

Subsidiaries in Macedonia can properly perform the activities on the market as soon as the registration certificate is issued by the Central Registry of the Republic of Macedonia. This is an important document that shows the company is legally incorporated in Macedonia and it can be received once the Articles of Association, the declaration of the parent company that wants to establish a subsidiary in this state, the specimen signatures of the owners and directors of the subsidiary are submitted to the Central Registry. It is good to know that the certificate of incorporation is normally released within a few days if all the documents are accepted by the institutions in charge of the registration.

There is no need for an annual audit if the revenues do not surpass EUR 170,000. This regulation is imposed on large subsidiaries, specifically for those activating in the insurance or banking sector in Macedonia.

The advantages of a subsidiary in Macedonia

Subsidiaries in Macedonia benefit from the business history and reputation of the foreign company, therefore, the intellectual property rights are protected. Moreover, subsidiaries can act independently and can also perform additional activities, different from the ones of the parent enterprise. A Macedonian subsidiary has the same financial structure and administrative services as the parent company and can activate with the same marketing strategies.

The assets of a subsidiary company in Macedonia can be invested in the same business if the foreign company considers so. In a competitive market full of opportunities, a subsidiary may represent the suitable form of business which guarantees success and profits in a fast and reliable manner. Another important advantage of a subsidiary in Macedonia is related to the tax regime and particularly to the benefits offered by the double tax treaties signed with more than 35 countries. In this situation, the withholding tax is set at 10% but in some cases, it may not be imposed.

The minimum share capital for a subsidiary in Macedonia

As mentioned earlier, a subsidiary can be created with the help of an LLC and a minimum share capital of EUR 5,000. The registration process of a subsidiary on Macedonia starts at the Central Registry of the Republic of Macedonia or simply the Trade Register and follows the same formation steps as for any kind of business. In this sense, the Articles of Association are mandatory at the time of formation of the subsidiary in Macedonia, following the next steps which involve:

- • the tax compliance and the application for VAT in agreement with the applicable laws;

- • applying for the company’s seal in order to legally operate on the market;

- • hire staff and bear in mind the requirements for the employment contracts;

- • solicit the services of an accounting firm in Macedonia for payroll, bookkeeping, annual financial statements, etc.

Interested in more about subsidiaries in Macedonia in 2023? Feel free to discuss with our specialists in company formation in Macedonia.

Who can establish subsidiaries in Macedonia?

All foreign companies are welcomed to set up their subsidiaries in Macedonia, without any particular restrictions, as long as the local legislation is respected. The financial sector is preferred by companies from abroad looking to enlarge their portfolios in a stable and respected business field. However, sectors like IT, communication, engineering, food & beverage or media are also on the list of big enterprises from overseas interested in opening subsidiaries in Macedonia. Even if the formalities are not that complicated, it is recommended to get in touch with our team of consultants and find out more about the ways in which we can provide support and information when opening a company or establishing a subsidiary in Macedonia. They can also help you register a subsidiary for VAT.

A bank account for a subsidiary in Macedonia

Yes, just like any other business in Macedonia, a bank account is needed at the time a subsidiary is established. All the financial operations need to be connected with a local bank account, and foreigners have the opportunity of choosing the preferred bank in Macedonia.

Employees for a subsidiary in Macedonia

Foreign entrepreneurs wanting to develop the activities in Macedonia can direct the attention to the available labor force in this country. With a highly educated and experienced workforce, Macedonia provides multiple choices in terms of labor force. More than that, investors from abroad may benefit from varied incentives and tax exemptions if they decide on hiring local staff for their companies in Macedonia. Let us offer you complete assistance and information if you are interested in hiring local staff for your business in Macedonia. All the requirements with the entitled authorities can be handled by our team of company formation agents in Macedonia.

Subsidiaries protected by DTTs

It is good to know that Macedonia signed a series of double taxation treaties through which all the businesses are protected from paying the taxes twice: once in the country of residence and once in the home country. Albania, Iceland, Norway, Egypt, France, Serbia, UK, Sweden, Turkey, Spain, Moldova, Belgium, Poland, Romania, Russia, Switzerland, Lithuania, Hungary, Croatia, the Netherlands are only a few of the countries that signed double taxation agreements with Macedonia.

We mention that the OECD model (Organization for Economic Cooperation and Development) model tax convention stand at the base of the double taxation conventions signed by Macedonia with countries worldwide. All the tax matters involving a company in Macedonia can be explained by our team of consultants at any time. You might want to know details about the accounting services we can provide for your company in Macedonia, also part of our services in this country, regardless of the city you want to develop your business.

Accounting services for subsidiaries in Macedonia

Hiring an accounting firm in Macedonia is the proper solution for companies in this country for many reasons, among which having all the financial operations in complete control. The Accounting Law in Macedonia stands at the base of most of the accounting matters, plus the international ones applicable worldwide. Bookkeeping, payroll services, VAT registration, tax advice, and compliance, plus tax minimization methods are provided by an accounting firm for companies in Macedonia. Audits in Macedonia are also important, therefore, ask our consultants in this matter and request a personalized offer if you want accounting services for your company in Macedonia.

Why open a subsidiary in Macedonia

Considering the proper business climate in Macedonia, the economic stability and the multitude of business offers, it is normal to see this country as a potential destination for your activities. It is good to know that foreign entrepreneurs can benefit from a 10-year corporate tax exemption if specific investments are made, among which hiring local staff. The reinvested profits in the firm may also be subject to varied tax incentives. Above all, the company registration in Macedonia has been simplified in the past years, allowing foreign investors to concentrate more on the business and the developments in the market.

For more information about how to establish a subsidiary in Macedonia in 2023, we kindly invite you to get in touch with our team of company formation representatives in Macedonia.